Irs Medical Travel Rate 2024. 1 and would apply to 2024 tax. Here is everything you need to know about the mileage rates, including how to claim this deduction for your business expenses, medical/moving, or in service of a charitable.

The 2024 irs mileage rate for medical travel is 21 cents while the business mileage rate is 67 cents per mile. For travel in 2023, the rate for most small localities in the united states is $59 per day.

The 2024 Medical Mileage Rate Is 21 Cents Per Mile.

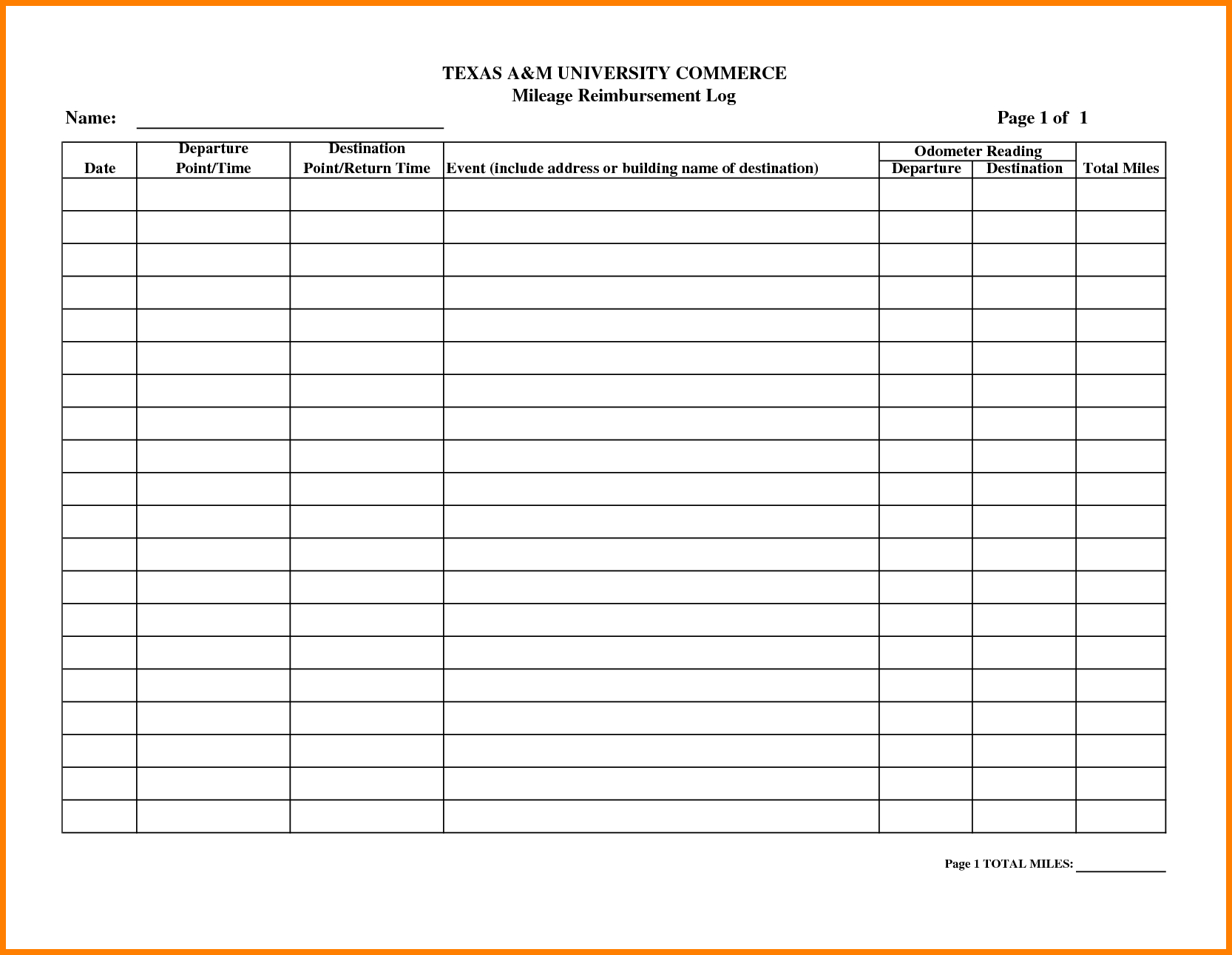

Find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes.

Trips Made In Service Of A Charitable Organization:

Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred while on official travel.

Irs Medical Travel Rate 2024 Images References :

Source: matricbseb.com

Source: matricbseb.com

IRS Mileage Reimbursement Rate 2024 All You Need to Know about the 1., 21 cents per mile driven for medical purposes. It discusses what expenses, and whose expenses, you can and can't include in figuring the.

Source: agnetabferdinanda.pages.dev

Source: agnetabferdinanda.pages.dev

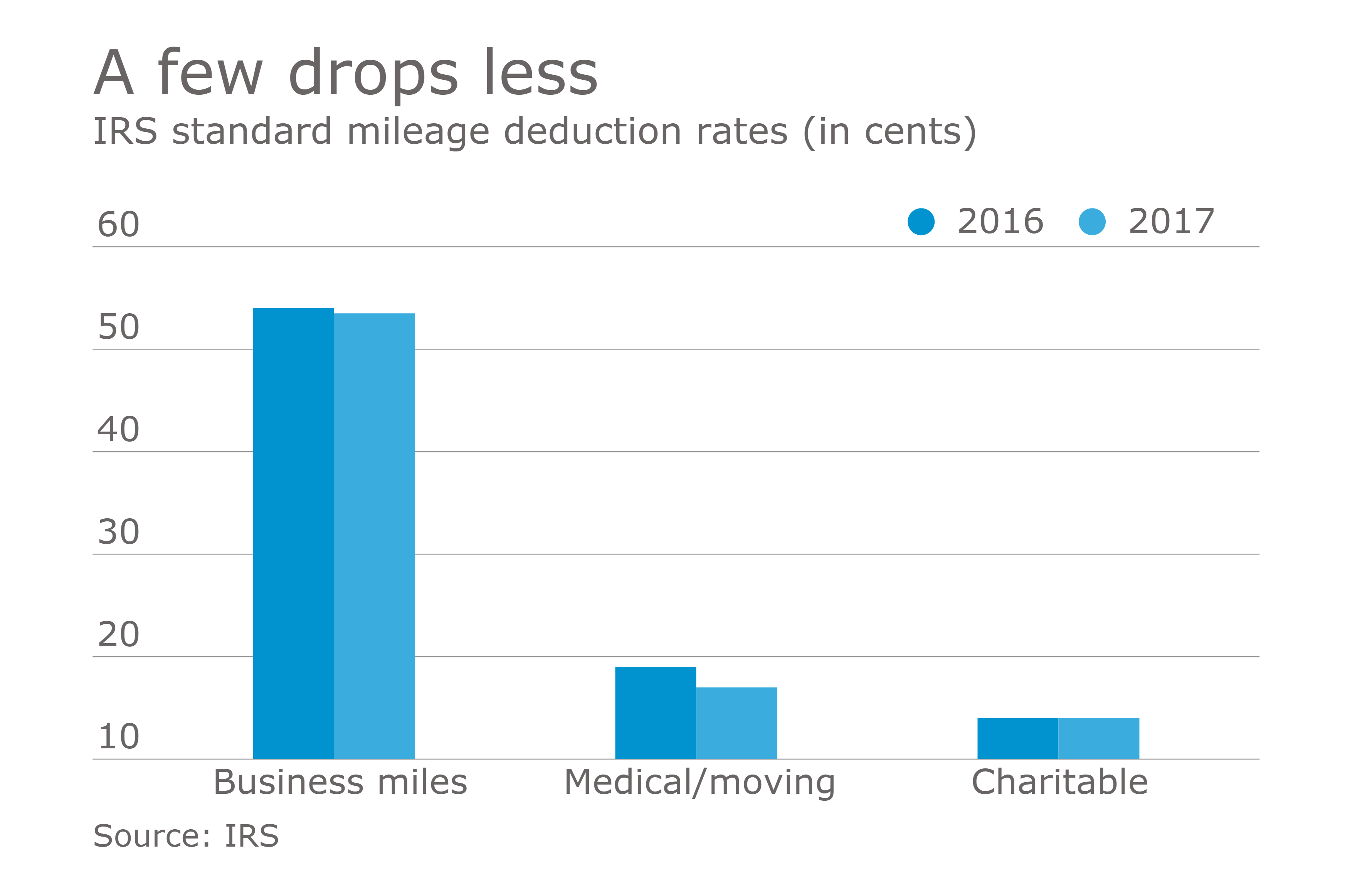

Irs Standard Mileage Rate 2024 Comparison Bevvy Chelsie, Mileage rate increases to 67 cents a mile, up 1.5 cents from 2023. For travel in 2023, the rate for most small localities in the united states is $59 per day.

Source: rianonwgerty.pages.dev

Source: rianonwgerty.pages.dev

2024 Irs Travel Reimbursement Rate 2024 Xenia Karoline, This publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). You will also be able to claim parking and toll fees on top of the.

Irs Mileage Rate 2024 Medical Travel Kiri Ophelie, Yes, you can deduct mileage for. The standard meal allowance is the federal m&ie rate.

Source: maudermengarde.pages.dev

Source: maudermengarde.pages.dev

Irs 2024 Mileage Rate Deina Eveline, The irs has announced a midyear increase in the standard mileage rates for business and medical use of an automobile, and for deducting moving expenses. The medical mileage rate set for 2024 is 21 cents per mile.

Source: maudermengarde.pages.dev

Source: maudermengarde.pages.dev

Irs Mileage Rate 2024 Florida Deina Eveline, This year, the irs raised the mileage rate for 2024 to 67 cents per mile, which is 1.5 cents more than the previous year’s rate of 65.5 cents per mile. 67 cents per mile driven for business use.

Source: korrybroseanne.pages.dev

Source: korrybroseanne.pages.dev

Current Irs Mileage Rate 2024 Deduction Gretta Cecilla, 14 cents per mile for service of charitable organizations, unchanged from 2023. You will also be able to claim parking and toll fees on top of the.

Source: mableyconsuela.pages.dev

Source: mableyconsuela.pages.dev

Irs Standard Mileage Rate 2024 For Medical Kali Samara, 1, 2024, the standard irs mileage rates for cars (also vans, pickups, or panel trucks) are as follows: The new irs mileage rates for 2024 are 67 cents per mile for business purposes (up from 65.5 cents per mile in 2023), 21 cents per mile for medical or moving purposes and 14 cents per mile for charitable purposes.

Source: twitter.com

Source: twitter.com

IRSnews on Twitter "The IRS has issued the 2023 optional standard, We review how to anticipate 2024 income with deductions for business or medical use of a car. Most major cities and many other localities in the.

Source: francoisewrheba.pages.dev

Source: francoisewrheba.pages.dev

Irs Travel Rates 2024 Max, You will also be able to claim parking and toll fees on top of the. 65.5 cents per mile for business.

The 2024 Medical Or Moving Rate Is 21 Cents Per Mile, Down From 22 Cents Per Mile Last Year.

1, 2024, the standard irs mileage rates for cars (also vans, pickups, or panel trucks) are as follows:

The Irs Has Announced A Midyear Increase In The Standard Mileage Rates For Business And Medical Use Of An Automobile, And For Deducting Moving Expenses.

The standard meal allowance is the federal m&ie rate.

Category: 2024